The financial strain of utility payments is a pressing issue, with many juggling between essential expenses like electricity and other basic needs. Recent data reveals troubling trends, from widespread electricity cutoffs to skipped meals and delayed medical care just to keep the lights on.

This article examines these critical findings, exploring the frequency and causes of missed utility payments in the U.S., preferences for manual versus automatic bill pay, and the broader economic challenges that make electricity an unattainable luxury for some.

Key Takeaways

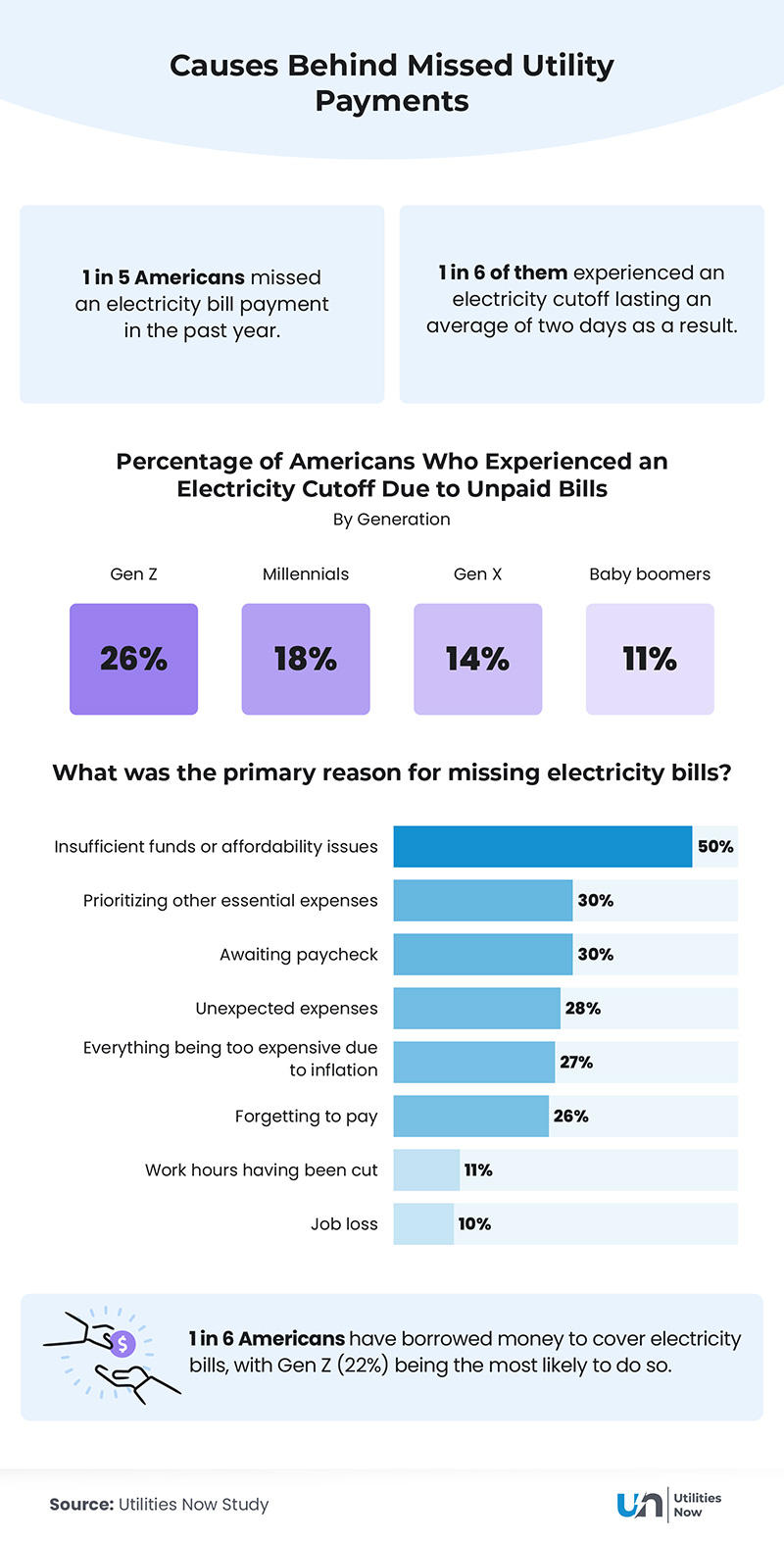

- 1 in 6 Americans have experienced an electricity shutoff due to unpaid bills, especially Gen Z (26%).

- 1 in 6 Americans have borrowed money to cover electricity bills, and Gen Z is the most likely to have taken on debt in order to do so (22%).

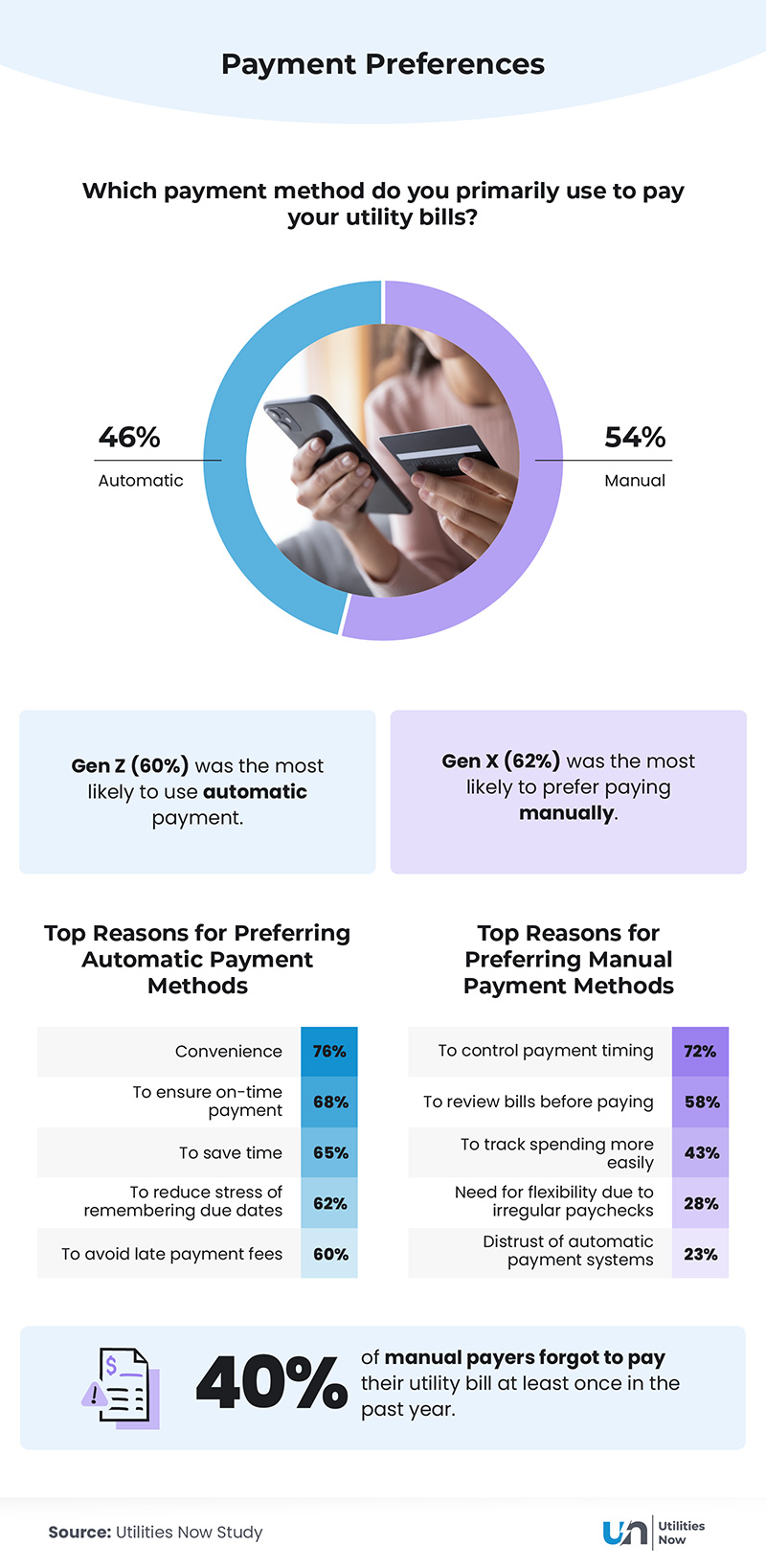

- 40% of people who pay their utilities manually (rather than using automatic payments) have forgotten to pay their utility bills at least once in the past year.

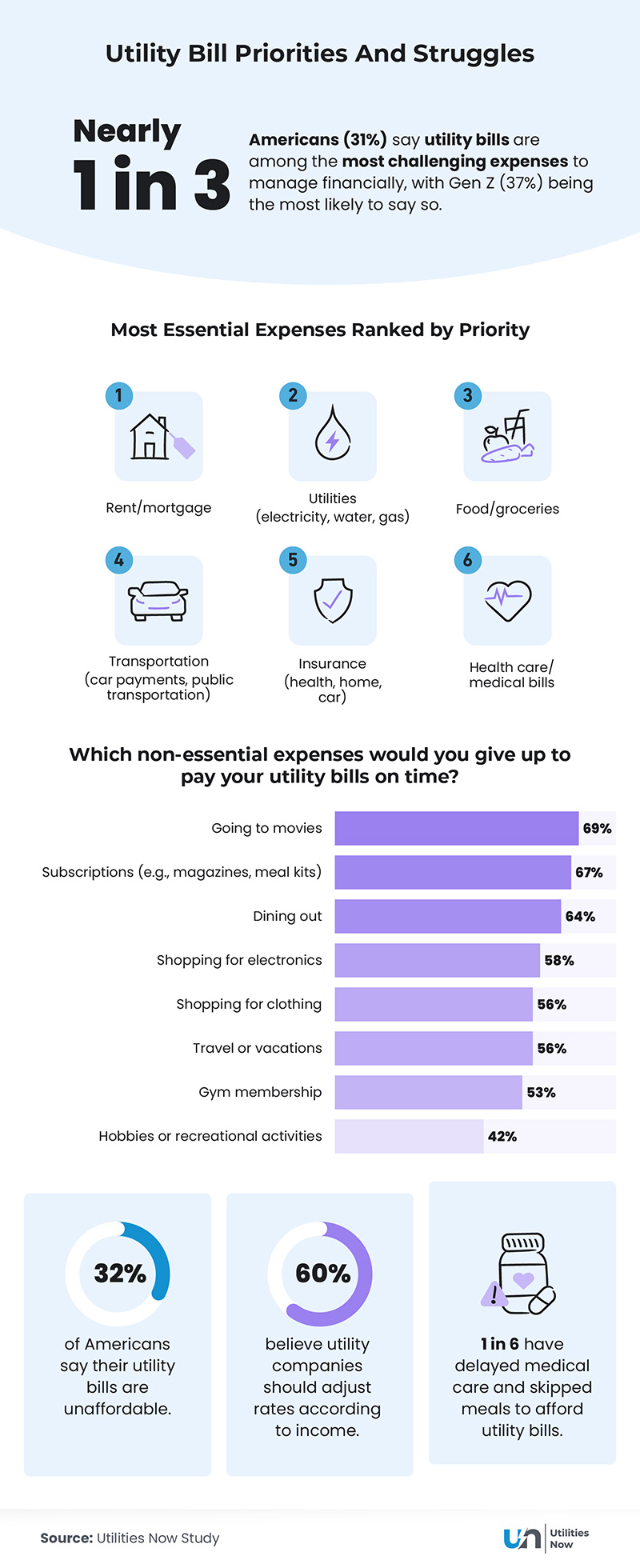

- 1 in 6 Americans have delayed medical care and skipped meals to afford their utility bills.

- 32% of Americans say their utility bills are unaffordable, and 60% believe utility companies should adjust rates based on income.

- Gen Z is the most likely to have skipped meals to pay utility bills (22%), while 18% of millennials and 15% of Gen Z have delayed medical care for this reason.

Power Struggles

- 1 in 6 Americans have experienced an electricity shutoff due to unpaid bills, especially Gen Z (26%).

- Among Americans who missed paying their electricity bill on time in the past year, 73% missed it more than once.

- On average, Americans have missed paying their electricity bill three times in the past year.

- Percentage of Americans who missed paying their electricity bill on time in the past year:

- By generation:

- Gen Z: 18%

- Millennials: 21%

- Gen X: 24%

- Baby boomers: 9%

- By housing situation:

- Renters: 28%

- Owners: 14%

- By generation:

- 32% of manual payers were more likely to have missed a payment compared to just 7% of auto-payers.

- Among the 17% of Americans who had their electricity cut off due to unpaid bills in the past year, 37% had experienced this more than once.

- 1 in 6 Americans have borrowed money to cover electricity bills, and Gen Z is the most likely to have taken on debt in order to do so (22%).

Convenience vs. Control

- 1 in 10 Americans (especially Gen Z, at 14%) prefer automatic payment methods because they offer discounts or rewards from service providers.

- 1 in 16 Americans (especially Gen Z, at 18%) prefer to pay manually to avoid the inconvenience of setting up automatic payments.

- 40% of manual payers have forgotten to pay at least one utility bill in the past year.

- Millennials (46%) are the most likely to have forgotten to pay at least one utility bill in the past year.

Balancing Priorities

- 46% of Gen Z and 57% of millennials would give up travel to pay for their electricity bills on time.

- Gen Z (22%) are the most likely to skip meals to afford utility bills.

- 18% of millennials and 15% of Gen Z have delayed medical care to pay utility bills.

- 21% of millennials and 22% of Gen Z believe their utility bills are unaffordable.

- 32% of Americans say their utility bills are unaffordable, and 60% believe utility companies should adjust rates based on income.

- 1 in 6 Americans have delayed medical care and skipped meals to afford their utility bills.

Methodology

We surveyed 1,007 Americans in December 2024 about the financial and behavioral factors driving missed utility payments. The generational breakdown was Gen Z (13%), millennials (51%), Gen X (27%), and baby boomers (10%).

About Utilities Now

Utilities Now makes choosing utility services simple. We help you compare rates and terms from different providers and empower smart utility choices.

Fair Use Statement

The findings and data presented in this article are intended for educational and informational purposes. If you choose to share or reference this content, please credit the original source and link back to this page. This ensures that the research is accurately represented and accessible to others who may benefit from these insights.